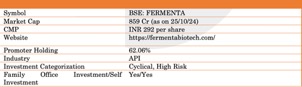

Adezi Ventures Investment Note - Oct 2024

Company Introduction

Fermenta Biotech Limited (FBL), established in 1951, is a prominent player in the global pharmaceutical and biotechnology sectors. Over its seven-decade history, FBL has distinguished itself as a leader in Vitamin D3 production, becoming one of the top three manufacturers globally. They offer a diverse range of Vitamin D3 variants used in human nutrition, animal feed, and veterinary applications.

Beyond its Vitamin D3 expertise, FBL is also involved in the production of active pharmaceutical ingredients (APIs) and environmentally focused solutions, including enzymes for pharmaceutical manufacturing and wastewater treatment. With a global presence in over 60 countries and more than 350 clients, Fermenta Biotech is well-positioned to continue its expansion and diversification into nutraceuticals and other high-growth sectors

Our Investment Thesis

In our view, Fermenta Biotech, having successfully navigated a challenging period characterized by subpar Vitamin D API prices last year, is poised to capitalize on the recent surge in market prices of the commodity. Despite facing pricing pressures that fell below production costs in 23/24, the company’s prudent capital management and strategic use of its real estate portfolio have demonstrated its resilience.

We believe that the sudden dramatic increase in Vitamin D API prices, which have reached USD 30-35 per unit in the Chinese, European, and American markets as of July 2024 from an average of USD 8 per unit last year could completely transform the P&L and balance sheet for the company this year.

Price data source : allaboutfeed.net

Given that Vitamin D accounts for approximately 53% of Fermenta Biotech’s sales, we anticipate this price surge to significantly boost the company’s EBITDA. This year’s Vitamin D-related profits are expected to substantially offset any decline in earnings from the real estate segment.

While the financial results up to Q4’24 primarily reflect the impact of unsustainable Vitamin D prices, we anticipate a strong recovery period for the company’s financials in H2’24 and H1’25. As new contracts are signed at higher prices for part Q3 and most of Q4 of 2024, the positive impact of these price increases is expected to materialize and we expect OPMs to exceed 20% for these periods. OPMs in previous periods with high Vitamin D prices have even been >30%. This momentum could well persist as long as Vitamin D prices remain elevated or even return to normal levels. Moreover, with the core businesses regaining traction, Fermenta Biotech can also focus on its new growth initiatives.

To provide a more conservative outlook, we have modelled various earnings estimates based on different Vitamin D price scenarios. Even under a scenario where Vitamin D prices average USD 20-25 over the next year versus the latest prices of > USD 30, we believe that Fermenta Biotech can achieve an EBITDA of over INR 150 crore next year, even with reduced real estate profits. Considering high EBITDA growth ahead and past multiples in bull cycles, we believe the current valuation of 6 EV EBITDA on this 150 Cr number is very attractive especially considering envisaged OPM expansion

Disclaimer: These notes are only our internal opinions and records at Adezi Ventures Family Office. These do not constitute any kind of investment advice or recommendations.